Will Warren Buy Lee Enterprises Again

Warren Buffett sells newspaper empire to Lee Enterprises

Berkshire is lending Lee coin to purchase papers

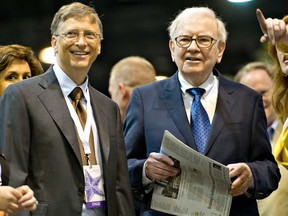

Warren Buffett is getting out of the paper business.

Berkshire Hathaway Inc. agreed to sell its BH Media unit of measurement and its thirty daily newspapers to Lee Enterprises Inc., which owns papers including the St. Louis Post-Dispatch, for US$140 one thousand thousand in cash. Lee has been managing the papers for Buffett's company since 2018, and Berkshire is loaning Lee the money for the purchase.

Buffett, who got a job delivering papers as a teenager and invested in the industry to capitalize on its i-time local advertising stronghold, lamented last year that nearly newspapers are "toast." BH Media, which owns papers across the country, has been cut jobs for years to cope with failing ad acquirement.

We believe that Lee is all-time positioned to manage through the industry's challenges

"We had zero interest in selling the group to anyone else for 1 uncomplicated reason: We believe that Lee is best positioned to manage through the industry'southward challenges," Buffett said in a statement Wednesday.

Mary E. Junck, the chairman of Lee Enterprises' lath of directors, is also on the board of Postmedia Network Inc., which owns the Financial Post.

In 2018, Buffett acknowledged that he was surprised that the decline in need for newspapers hadn't let upward and that his visitor hadn't plant a successful strategy to gainsay falling advertising and apportionment. That aforementioned year, U.South. newspaper apportionment dropped to its everyman levels since 1940, co-ordinate to the Pew Research Center.

-

The couple who scammed Warren Buffett's Berkshire Hathaway for millions

-

Home Uppercase looks for second act subsequently its remarkable bounce back from the brink

-

Still betting on Warren Buffett: Berkshire Hathaway and ix other stocks that could intermission out in 2020

The Lee sale volition include Buffett'due south hometown Omaha World-Herald and Buffalo News, a newspaper he's owned for more 4 decades, along with 49 weekly publications and a number of other print products, the companies said in the statement. Lee's shares jumped on the news, more than doubling to Usa$2.78 at 9:51 a.thou. in New York.

Lee Loan

Berkshire is lending Lee United states of america$576 million at a nine per cent annual rate for the purchase and to refinance other debt. Excluded from the sale is BH Media's existent estate, which Lee is leasing under a 10-yr agreement.

It's a rare move for the conglomerate every bit Buffett has long said that he prefers to hold onto businesses. The newspaper deal, however, is Berkshire's second divestiture in less than a year, including the sale of an insurance business organization in late 2019. Berkshire has held onto other old-fashioned businesses, including door-to-door vacuum-cleaner business Kirby Co. and encyclopedia publisher World Volume.

Buffett has longstanding ties to the newspaper manufacture. He previously endemic the Omaha Sun, which won a Pulitzer Prize for its investigation of Boys Town, and struck a deal to buy the Globe-Herald in 2011. The billionaire investor too had a long friendship with and was a business bus to Katharine Graham, and was a director at her Washington Mail service Co.

Aside from a few bright spots, such as the largely thriving New York Times Co., the newspaper business is in crisis beyond the U.South. McClatchy Co. — which owns about 30 newspapers, including the Miami Herald and Charlotte Observer — is fighting to avoid bankruptcy as information technology contends with pension obligations and debt. The Salt Lake Tribune became a nonprofit terminal yr, after failing to find a profitable business organization model.

Equally print advertising has cratered in recent years amongst the rising of social media, Craigslist and search ads, individual disinterestedness firms and hedge funds take swooped in to take advantage of newspapers' steady though dwindling revenue streams.

New Media Investment Group Inc., controlled by individual equity business firm Fortress Investment Group LLC, bought U.s. Today owner Gannett Co. terminal year to class the largest U.Southward. paper chain. The deal spurred apprehension in journalism circles given New Media'south reputation for newsroom layoffs, though the new Gannett leadership pledged to avoid widespread task cuts.

Bloomberg.com

delatorreacqualatithe.blogspot.com

Source: https://financialpost.com/telecom/media/warren-buffett-throws-in-the-towel-on-his-newspaper-empire-0130-bc-warren-buffett-throws-in-the-towel-on-his-newspaper-empire-bloom-696-words-f-01-29-20-0953-am

0 Response to "Will Warren Buy Lee Enterprises Again"

Post a Comment